Taxes and cryptocurrency: Important moments to consider

Watch this article on YouTube

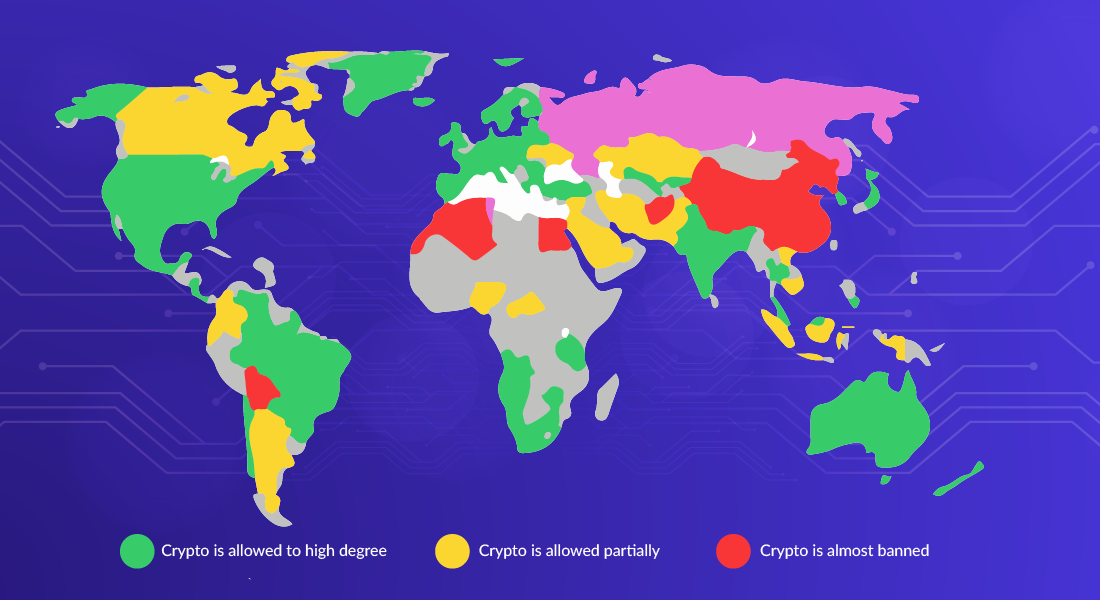

In the world of cryptocurrencies, taxation is becoming an increasingly relevant topic. Different countries apply different approaches to the taxation of cryptocurrencies, and investors need to understand these differences. In our today's article, we will look at how different countries tax cryptocurrencies. Please note that the following data is relevant for the summer of 2023.

Germany

Germany does not consider cryptocurrency a capital asset, which means there is no capital gains tax for long-term investors. If you hold your cryptocurrency for more than a year and then sell it, you will not pay any tax. However, if you sell your cryptocurrency before the end of the year, you will pay tax if the profit from the sale exceeds 600 euros. This makes Germany attractive to long-term investors who can plan their investments in such a way as to minimize their tax liabilities.

Cayman Islands

There is no capital or income tax for residents in the Cayman Islands. There is also no corporate tax for business. This makes the Cayman Islands an attractive destination for crypto investors and businesses.

El Salvador

El Salvador became the first country to accept Bitcoin as a legal means of payment. All foreigners are exempt from paying taxes on any income from the increase in the value of Bitcoin, which makes El Salvador attractive for investors in Bitcoin.

Malaysia

Malaysia does not consider cryptocurrency a capital asset, meaning cryptocurrency is tax-free in the country. However, if a cryptocurrency is a regular source of income, it may be subject to taxation.

Malta

Malta does not tax all long-term profits received from the sale of your cryptocurrency if it is recognized as a store of value. In addition, Malta is attractive for long-term investors.

Switzerland

Switzerland is considered one of the best places in the world for financiers because of its soft approach to taxation. Individual investors who do not trade or engage in mining at a professional level are not subject to capital gains tax.

Puerto Rico

Even though Puerto Rico is a territory of the USA, the local government has different views on taxes. Puerto Ricans are subject to a much lower federal income tax rate than Americans in the USA. Such a situation makes Puerto Rico an attractive destination for American crypto investors.

Belarus

In March 2018, Belarus decided to use a very insightful approach to cryptocurrency. Unlike most European countries that introduced some cryptocurrency tax laws during the Bitcoin era, the country decided to legalize cryptocurrency transactions and exempt all businesses and individuals from any cryptocurrency tax until 2023.

Singapore

Singapore has no capital gains tax. In other words, it doesn't matter if you make a profit from selling your cryptocurrency or trading it. You won't be required to pay any income tax.

Portugal

In 2018, the Portuguese government declared all profits from the sale of cryptocurrencies tax-free. The Portuguese government has also stated that all income received from cryptocurrency trading is exempt from taxes.

Conclusion

In conclusion, as you can see, the taxation of cryptocurrencies varies depending on the country. Some countries consider cryptocurrency a capital asset, while others exempt profits from cryptocurrency from taxes. It is important that investors are aware of tax obligations in their country and receive appropriate tax advice.

Test Your Knowledge

- How is cryptocurrency taxed in Germany?

a. As a capital asset.

b. As income from trading.

c. It is not taxed if kept for more than a year. - What unique decision has Belarus made regarding the taxation of cryptocurrencies?

a. It started to tax all cryptocurrency transactions.

b. It exempted all cryptocurrency transactions from taxes until 2023.

c. It started to tax only transactions with Bitcoin. - What is the cryptocurrency taxation policy in Singapore?

a. It is taxed as capital gains.

b. It is not subject to capital gains tax.

c. It is taxed only when one sells cryptocurrencies.

Correct answers: 1 c, 2 b, 3 b.

Contents